The financial crisis of 2008 had a significant impact on the financial services industry, putting banks and financial institutions under increased scrutiny as they had to regain the public’s trust and learn to comply with the growing number of regulations. Before 2008, a bank dealt with 10 regulatory changes per day, but in 2017 this figure skyrocketed to 185.

The ever-changing regulatory landscape coupled with new cybersecurity threats and data breaches make the task of managing regulatory risk and compliance a complex and costly endeavor. And that’s where RegTech can help. Touted as “the new FinTech” by Deloitte, RegTech has quickly gained prominence as a simpler and faster way for companies to automate time-consuming operational tasks and reduce risks associated with compliance and reporting requirements.

What is RegTech?

Regulatory technology, or RegTech, is an umbrella term for a range of digital solutions and tools that help financial institutions and companies enhance their regulatory and compliance processes. The term RegTech was first coined by the UK’s Financial Conduct Authority (FCA) and defined as “subset of FinTech that focuses on technologies that may facilitate the delivery of regulatory requirements more efficiently and effectively than existing capabilities”. To achieve these operational efficiencies, RegTech uses a number of cutting-edge technologies like machine learning, robotic process automation (RPA), cloud computing, big data analytics, and more.

As the importance of adopting RegTech solutions to solve complex compliance and security demands becomes clear, RegTech investments are soaring high. Just last year, RegTech companies raised around $18.9 billion in funding deals, which is more than double of the amount raised in 2020.

Key growth drivers for RegTech solutions

As we have already mentioned, constantly evolving regulatory requirements are the primary driver for the growing RegTech market, but not the only one. Main growth factors include:

- Regulatory complexity is growing. Every country has its own financial regulatory authorities. In the US alone, there are at least 14 banking and securities regulators, including Federal Reserve System (FRS), National Credit Union Administration (NCUA), Consumer Consumer Financial Protection Bureau (CFPB), Securities and Exchange Commission (SEC), and more. And each regulatory body has its own standards, provisions, and requirements, which makes the amount of regulatory information grow at an exponential rate.

- Compliance efforts are extremely resource-consuming. The cost and effort of regulatory compliance continues to be a major challenge. Each year, companies spend $80 billion globally on governance, risk and compliance. A third of firms spend at least one day per week tracking and analyzing regulatory changes.

- The cost of non-compliance is high. Given the time and effort put into following the applicable laws and regulations, the cost of compliance is high but the penalties for non-compliance can be even higher. For example, Goldman Sachs paid a record MiFID fine of $45 million for failure to provide accurate reporting.

It’s evident that RegTech solutions are vital for financial companies to reduce the everyday complexity of managing regulatory compliance. But how do you build one?

Building a RegTech solution: Step-by-step plan

Every software development project requires detailed planning, and even more so RegTech solutions that involve complex areas and concepts. Essentially, the overall plan includes the following steps:

Identify your needs

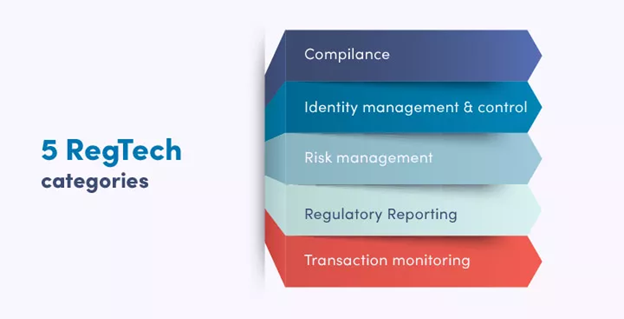

Before you dive right into your RegTech project, you need to know what kind of solution your financial company needs. From KYC solutions to risk assessment tools, the RegTech landscape is very diverse. Deloitte analyzed over 300 RegTech companies and broke them down into 5 main categories.

Source: Selleo

Compliance

RegTech solutions that fall under this category help keep up with the latest regulatory changes and new rules. These solutions often utilize machine learning to automatically search for new regulations and updates, analyze information, and communicate the findings.

Identity management and control

This category of solutions cover Know Your Customer (KYC) processes as well as Anti-Money Laundering (AML) and anti-fraud procedures. These solutions leverage biometrics technology and machine learning to make sure the digital identity of clients matches their real-world identities.

Risk management

Another challenge solved by RegTech solutions is optimizing complex risk management processes. By using advanced big data analytics, these solutions can detect fraud, identify insecure situations, predict market changes and similar risks.

Regulatory reporting

The reporting process can also be optimized with the help of RegTech solutions that use machine learning algorithms to prepare, process and validate data, and automatically classify and categorize it, reducing the risk of human error and saving time.

Transaction monitoring

This group of RegTech solutions are concerned with real-time monitoring of financial transactions and other customer activity to identify irregularities and potential threats. Any outlier is further analyzed to determine if fraudulent activity is taking place.

Find an expert team

Whether you choose to engage an in-house team or outsource your project to a third-party vendor, the first thing to pay attention to is domain expertise. Given how complex regulatory compliance is, it is vital for your team to have deep knowledge of FinTech and RegTech sectors to build the right architecture and make the product fully compliant.

As a company that builds enterprise-grade financial solutions, Elinext knows that a RegTech project requires a full-fledged squad that includes a software architect, developers, UI/UX specialist, QA engineers, security experts, and DevOps engineers.

Choose the technology stack

Choosing the right tech stack is a crucial step as it affects the cost and time to market. In addition, going with the wrong language, platform or third-party tool can negatively impact your solution’s scalability, performance, and security.

The most popular programming language for financial solutions is undoubtedly Python as it is scalable, easy to use, and offers an extensive open-source library, which translates into a faster development process. Java, too, is favored by many financial institutions due to its cross-platform interoperability and security. If your solution requires advanced computations and concurrent operations, C++ will be the best choice.

Develop an MVP

A minimum viable product, or MVP, is a great way to test the idea before investing in a long-term project. An MVP serves as a proof of concept that includes essential features that users can try out to see if the solution brings the intended value. This feedback will provide the insights necessary to inform and optimize your overall project development strategy.

Take care of quality

Quality can never be an afterthought, especially for solutions that deal with regulation and compliance technology. As we have already mentioned, your team must include a QA unit that would prepare and implement a thorough test plan covering functional, security, load, performance testing as well as compliance checks.

Ensure infrastructure security

Tight security is a core component of RegTech solutions, but it shouldn’t be limited only to apps. From back-end servers and databases to the network, you need to prioritize security at all levels. Infrastructural security typically combines a range of solutions and protocols like robust firewalls, antivirus solutions, proxy servers, end-to-end data encryption, multi-factor authentication, and more.

The bottom line

In 2019, the global RegTech market was valued at $5.46 billion and it is expected to reach $28.33 billion by 2027, growing at a CAGR of 22.3%. If anything, these numbers indicate that financial institutions and banks treat RegTech solutions not as a fancy tool but as a vital necessity to cope with the growing regulatory complexity, avoid costly errors, and streamline internal operations.