In today’s world, the customer experience (CX) reigns supreme. As companies are often competing on value and not on price, customer centricity has quickly become the core element of a successful business strategy. When it comes to the highly saturated financial services market, CX turns out to be one of the key differentiators that can help both incumbent banks and fintech startups gain users’ loyalty and improve the bottom line. A recent report by McKinsey shows that banks with a high customer satisfaction score delivered 55% higher returns.

That said, there is still a significant delivery gap. According to Bain & Company, 80% of surveyed companies believed they delivered a superior customer experience. Customers however told a quite different story — they considered that only 8% of businesses actually delivered on the promise.

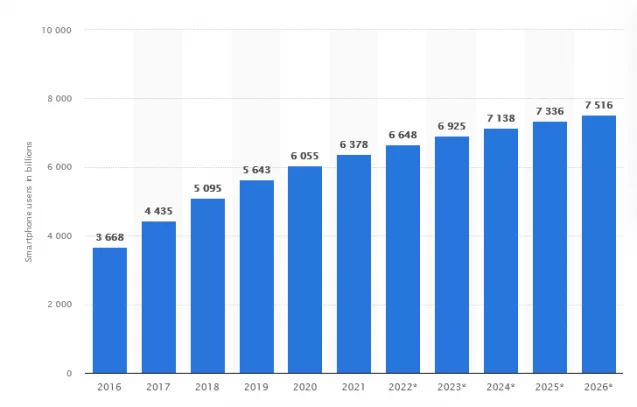

One of the ways to bridge this delivery gap is to leverage the mobile channel. The graphics below demonstrates the rapidly growing smartphone ownership.

Source: Statista

This shift towards the mobile-first world is not lost on banks. While traditional banks launch their mobile banking software solutions, challengers open mobile-only banks that bring customer experiences to a whole new level. In addition to 24/7 availability of financial services, here are four other ways how mobile banking apps can help you win customers’ loyalty.

Proactive communication

According to the latest stats from mobile data analytics firm App Annie, consumers now spend 4.2 hours a day using apps on their smartphones, which is 30% higher than just two years before.

Banks can leverage consumers’ love for mobile apps and effectively reach them right where they are. What’s more, banks can take a proactive position and use push notifications and in-app messaging for more effective communication. Whether it’s a transactional update, an account reminder, or a security alert, mobile push notifications keep users engaged while building positive brand perception. You can also use push notifications to connect users with additional resources (saving tips, loan types, investment advice, etc.) at each step of the customer journey, which can be highly beneficial for the overall user experience.

N26, voted world’s best bank by Forbes, actively uses push notifications to keep users up-to-date on their account activity whether it is a deposited paycheck or any suspicious or fraudulent transactions.

AI-driven personalization

There is no better way to enhance customer experiences than through personalization. Customers today expect brands to know their needs and preferences, and to serve them exactly what they are looking for, whether it’s a TV show for the next binge-watching session or a tailored financial investment plan.

By enhancing their banking software solutions with AI-powered analytics capabilities, banks can drive personalization on multiple levels. In addition to real-time UI customization based on previous user interaction, intelligent mobile banking apps can quickly process available customer data (demographics, geolocation, third-party data) to offer tailored savings strategies, custom wealth management plans, personalized balance reminders, and more, depending on the customers’ goals.

Underwrite.ai leverages advances in machine learning to revolutionize the underwriting process and outperform traditional models. The platform analyzes thousands of data points from credit bureau sources to accurately evaluate credit risk for each customer and reduce the default rate.

Smart assistance

When interacting with their banks and financial organizations, customers are looking not only for personalization but also for speed. Long response time and overall poor customer service can easily ruin the experience and make your customers switch to another financial services provider.

Chatbots have the potential to truly revolutionize the digital banking experience. Powered by artificial intelligence, these smart agents can instantly process even complex queries. From handling transactions to applying for a loan to updating on the balance, chatbots can provide customers with prompt and personalized interactions.

One such example is Nomi, an intelligent chatbot from Royal Bank. The virtual assistant sends reminders and personalized insights to enable users to make smarter financial decisions and manage their day-to-day spendings.

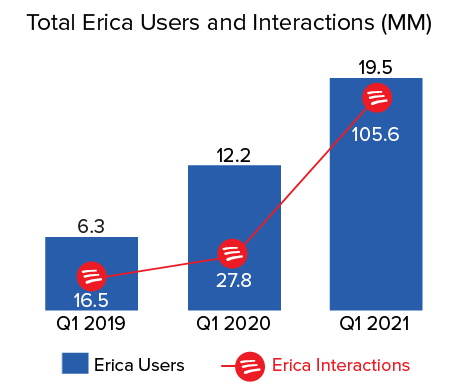

To take the customer experience to the next level, forward-thinking banks implement voice assistants into their mobile apps to capitalize on the convenience of voice-assisted interactions. So, Bank of America has added Erica, an AI-driven virtual assistant that helps users perform a range of banking operations. Customers can access balance information, transfer money, schedule meetings — all via voice commands.

As you can see on the graphics below, Erica has exploded in popularity in the first quarter of 2021:

Source: Voicebot.ai

Lifestyle banking

The next frontier in ensuring superior customer experiences is lifestyle banking. As customers’ needs and expectations are continuously evolving, they want more than a simple balance check or funds transfer — they want on-demand financial services seamlessly integrated into their lives.

Simply put, lifestyle banking leverages technology and user data to make consumers’ lives better and easier. Do your customers want more flexibility with their payment options, like P2P or QR payments? Or do they want something not completely related to banking, like finding a new car? One of the top banks in UAE, Emirates NBD has launched its digital lifestyle banking app Liv that allows users to book flights and tables, buy concert tickets, and more, among other things.

Another way to weave financial services even deeper into customers’ lives while boosting customer engagement is gamification. Look at Qapital, a personal finance mobile app that allows users convert actions into savings. Depending on the rules you set, the app can automatically send money to your savings account whenever a trigger event happens (e.g. posting on Twitter or buying coffee at Starbucks with a designated credit card).

Wrapping up

No matter the industry, the importance of great customer experiences can never be underestimated. Consumers who feel satisfied with the experience they have with your financial institution turn into lifelong customers and most loyal advocates of your business. According to Zendesk’s Trend Report, 75% of customers are willing to spend more with companies that deliver a good CX.

That said, people do not always trust banks and financial organizations when it comes to their personal finances. Therefore, building open and trustworthy relationships is of paramount importance for financial institutions.

Mobile apps turn out to be a powerful tool that can help you enhance the overall CX and become closer to your customers. From push notifications to hyper-personalized services and offers to AI-powered banking chatbots, mobile banking apps can help deliver positive customer experiences and bring immediate value.

At Elinext, we can help you build a custom mobile banking app aligned with your customers’ needs and requirements. Have a look at our case study on developing a robust financial app that runs seamlessly on Android.